Synthetic Long

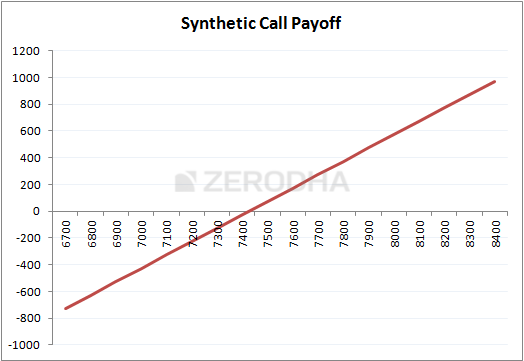

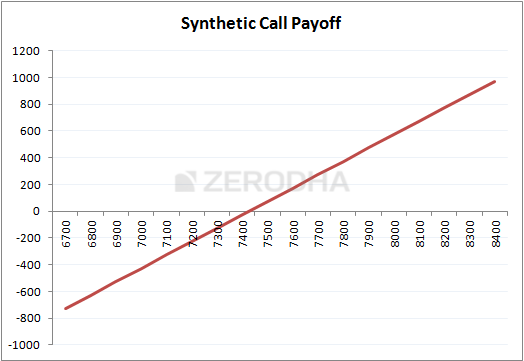

Mimics the payoff of the long futures instrument

Market View:

NA

Implementation:

Buy a ATM Call Option and Sell a ATM Put Option

- Buy 1 ATM call option (Leg 1)

- Sell 1 OTM Put option (leg 2)

Mimics the payoff of the long futures instrument

NA

Buy a ATM Call Option and Sell a ATM Put Option

Based on Put Call Parity, arbitrage equation is–

Long Synthetic long + Short Futures = 0

i.e Long ATM Call + Short ATM Put + Short Futures = 0

An arbitrage opportunity is created when Synthetic long + short futures yields a positive non zero P&L upon expiry