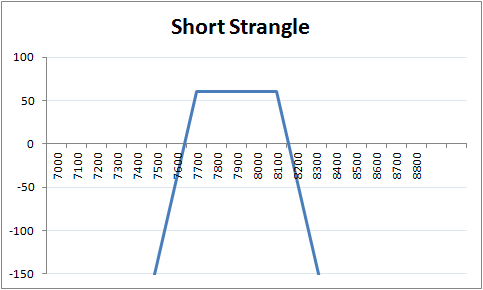

Market View

Range-bound, Not moving

Implementation:

Sell a Put below spot price(OTM) and sell a Call above the spot(OTM) price

- Sell 1 OTM Put option (Leg 1 - LS)

- Sell 1 OTM Call option (Leg 2 - HS )

Key trigger points:

- Net Credit = Call Premium + Put Premium

- Lower Breakeven = PE Strike - Net Credit

- Upper Breakeven = CE Stike + Net Credit

- Max Profit = Net Credit (Between LS and HS)

- Max Loss = Unlimited (on either side)