Implementation: Sell a call and buy a higher strike cheaper call for protection

- Sell 1 ITM Call option (Leg 1 - LS Large premium)

- Buy 1 OTM Call option (leg 2 - HS Small Premium)

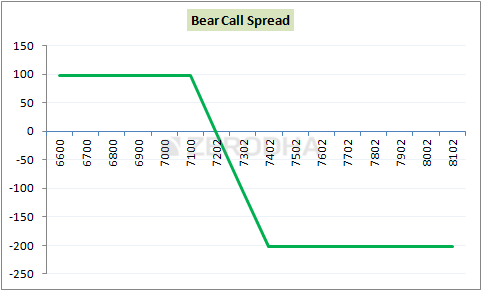

Key trigger points:

- Spread = Difference between the strikes

- Net Credit = Premium Received – Premium Paid

- Breakeven = Lower strike + Net Credit

- Max Profit = Net Credit (at or below LS)

- Max Loss = Spread – Net Credit (at or above HS)