Market View:

Very Bullish and Maket will move either direction

Implementation:

Sell 1 ITM Call options, Buy 1 ATM Call option and Buy 1 OTM Call option

- Sell 1 ITM Call option (Leg 1- LS High premium)

- Buy 1 ATM Call option (leg 2 - MS Mid Premium)

- Buy 1 OTM Call option (leg 3 - HS Low Premium)

Key trigger points:

- Spread(Ladder) = Difference between MS and LS

- Net Credit = Premium Received for ITM LS – Premium paid for (MS Mid Premium + HS Low Premium)

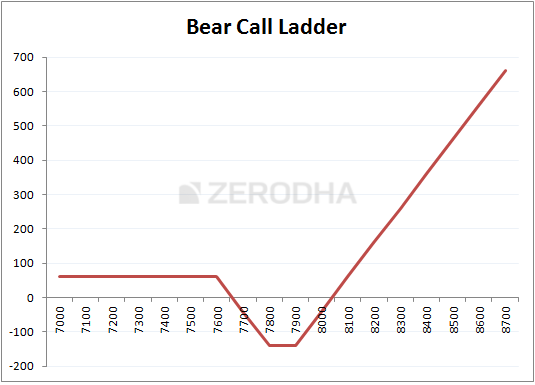

- Max Profit(when market is down) = Net Credit(at or below LS)

- Max Profit(when market is up) = Unlimited

- Max Loss = Spread – Net Credit (occurs beteen MS(ATM) and HS(OTM)

- Lower Breakeven = Lower Strike + Net Credit OR Middle Strike - Max Loss

- Upper Breakeven = (HS + MS ) - LS - NC OR Higher Strike + Max Loss